Logistics

Warehousing & Fulfillment

Transportation

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

Far from a passing fad, the subscription model is continuing to cement itself into consumers' routine spending habits, from streaming services to meal kit subscriptions or monthly subscription boxes. The subscription economy is anticipated to grow at a CAGR of 71% from 2023 to 2028, highlighting the importance of this revenue stream.

However, this doesn't mean subscription businesses aren't facing their fair share of challenges and disruptions. Growth has slowed as the retail sector recovers from the COVID-19 pandemic, with consumers feeling more comfortable shopping in person again. And with inflation putting a dent on consumer spending, brands need to think outside the box (pun intended) to create an offering capable of inspiring consumers to maintain their subscriptions.

So, what trends/changes in the subscription market should businesses be paying close attention to?

The retail subscription market is continuing to see strong growth, with subscription e-commerce forecast to generate more than $38 billion in revenue in 2023 -- more than double 2019 figures. However, ebbing consumer confidence is putting subscription-based businesses under pressure to prove their value.

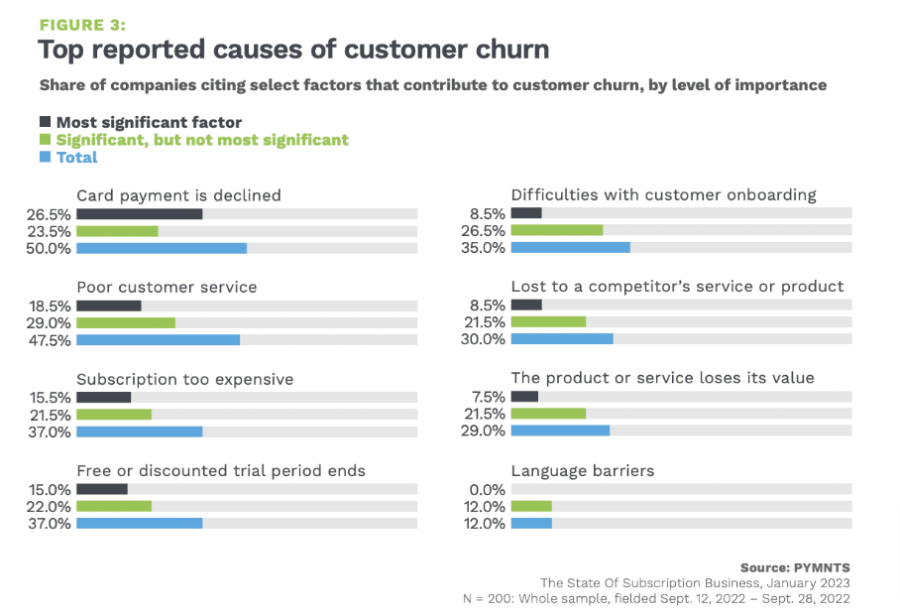

According to PYMNTS Subscription Commerce Conversion Index, 43% of subscribers are uncertain about renewing their current plans, while 22% of subscribers think it is very or extremely likely they will drop one or more of their subscriptions over the next year as they try to constrain spending.So, what determines whether a subscription stays or goes? A separate PYMNTS study surveyed subscription retailers to discover their biggest causes of customer churn, finding that billing problems, a poor customer experience, and cost were the three biggest reasons for losing customer relationships:

In this uncertain climate where consumers are watching their spending more closely and succumbing to 'subscription fatigue', subscription-based services need to make sure they have an iron-clad value proposition to keep subscribers interested and less likely to defect to a competitor.

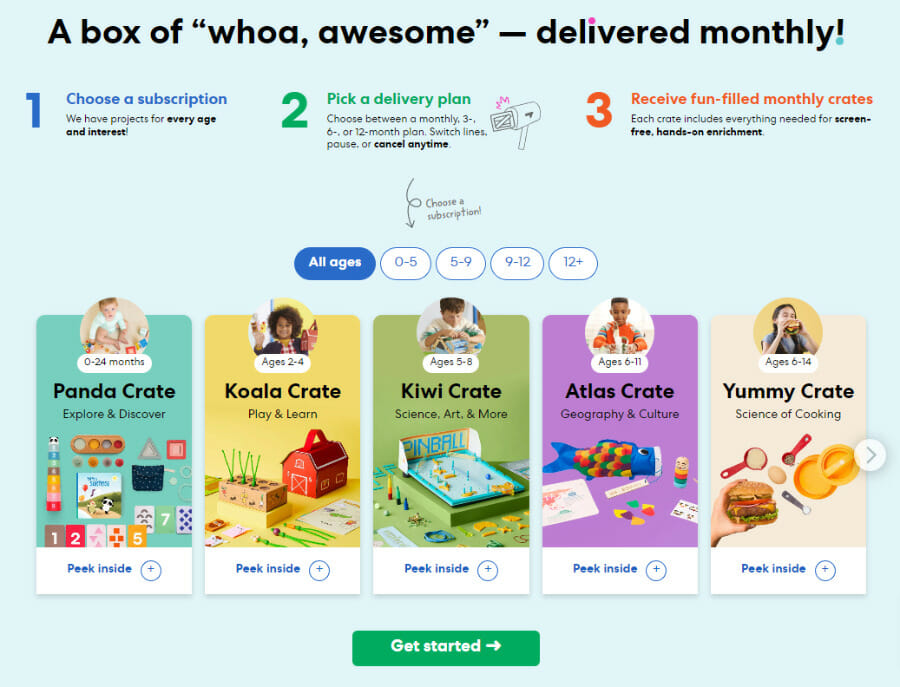

KiwiCo is far from the only kids' subscription box out there, but they've found a unique point of difference by ensuring that their subscription boxes evolve and stay age appropriate as children grow up. They offer multiple subscription plans tailored to specific age brackets, helping to lock in parents for longer subscription cycles by continuing to surprise and delight.

As inflation continues to bite, it's not surprising that subscribers are choosing to amend their subscriptions more often. According to Recharge's State of Subscription Commerce report 2023, 35% of subscribers adjusted their orders at least once during 2022. Of that group, 39% skipped at least one order, compared to 32% in 2021.

Allowing subscribers to make changes to their plans acknowledges that consumer needs are always changing. If customers feel locked into a rigid subscription model, they may become frustrated and eventually choose to cancel their subscription altogether. But if they have to option to skip an order, swap products, or reduce/increase the frequency of their subscription, it's far more likely they will stay put during tough economic times.

After struggles to achieve profitability amid disrupted supply chains, beauty subscription retailer Ipsy relaunched after consolidating with fellow subscription box BoxyCharm. In addition to using AI to personalize product selections, Ipsy now also allows subscribers to choose specific products or add products to ship with their box, creating a much more flexible subscription service.

During times of economic downturn, more expensive curated boxes or subscription services are much more vulnerable to customer churn, as well as being more resource-intensive for businesses to execute. As the subscription economy grows more saturated, convenience and affordability are key to keeping customers subscribed.

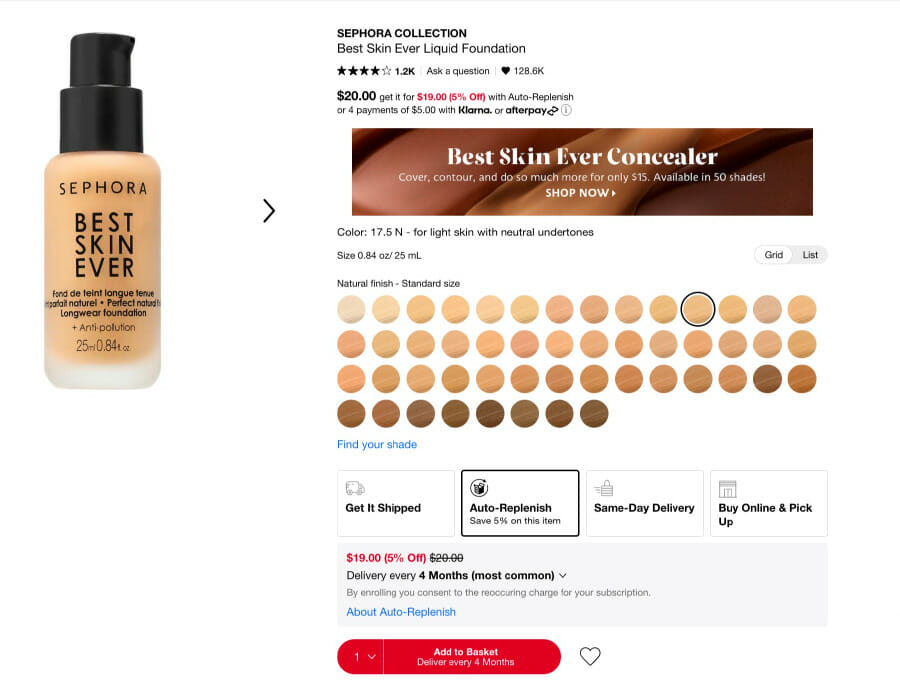

Replenishment subscription models are easy to manage because they offer the same product repeatedly. So long as brands can estimate correctly when customers require a refill or replacement, replenishment subscriptions are appealing to busy customers. If a product is either an essential item or belongs to an established routine, it has the potential to be repositioned as a subscription service and create a new revenue stream.

The beauty industry has an edge when it comes to replenishment subscriptions since so many products ultimately require replacement. Sephora has now added an auto-replenish option for suitable products such as skincare and foundation, allowing shoppers to choose a custom schedule and also receive a slight discount. By making it so easy for consumers to 'opt in' to subscriptions, Sephora is building an additional revenue stream alongside its more traditional Sephora Play subscription box. By mixing subscription business models in this way, Sephora can better appeal to personal preferences.

The nature of retail subscription services as a 'set and forget' system to minimize friction also makes subscription businesses more vulnerable to fraud activities. While some customers may genuinely forget they are subscribed to a subscription program and request a chargeback, others may falsely try to reclaim expenses from multiple cycles, which results in lost revenue and worsening relationships with financial providers.

Moreover, economic uncertainty has only given subscribers more motivation to commit fraud. According to sticky.io, 60% of subscribers say they have cheated their subscription retail services to receive extra benefits or save money. This behavior includes:

To combat fraud, consider implementing verification checks to check that subscribers are legitimate. This can include email and address verification. Fraud detection tools also use algorithms and machine learning to analyze data and detect suspicious activity, such as a large number of orders from a single IP address.

As the subscription business model matures, brands are discovering that the ROI of subscription retail isn't limited just to financial gains.

The nature of subscription services makes them a powerful segmentation tool for testing out new products, personalization strategies, VIP perks, and more before rolling them out to your wider customer base. In sum, subscription models provide a valuable source of data on consumer behavior to assess the effectiveness of different initiatives, helping to prevent costly, untested strategies from undermining your bottom line.

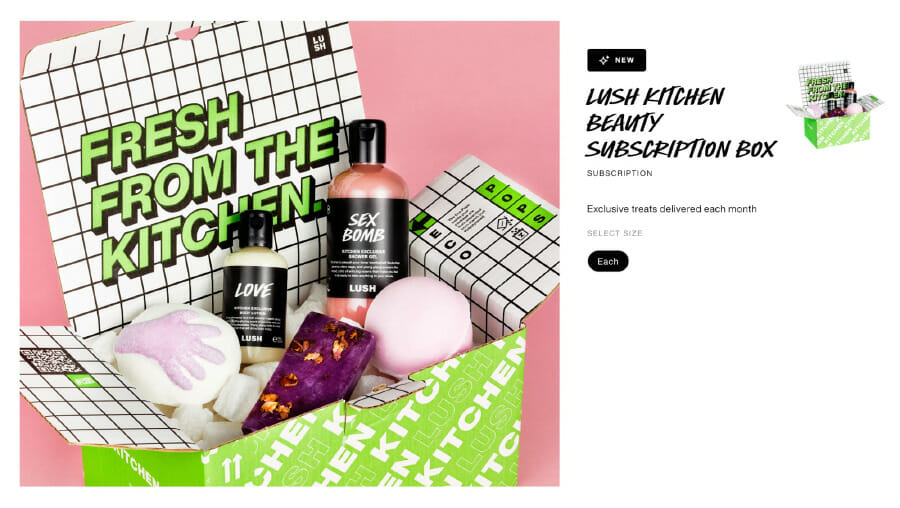

Lush's Kitchen Beauty Subscription Box offers a great example of how subscription services can provide a space for maintaining innovation and fresh ideas. These monthly subscription boxes include a selection of products that aren't available to regular Lush customers. Each month, subscribers have the chance to vote on what products they would like to see in their upcoming box. This gives the cosmetics brand access to valuable data on what products their most loyal customers would like to see, with the opportunity to make them storewide offerings in the future.

With the COVID-19 pandemic pushing customers to experiment with the subscription model in a whole new way, subscription services are not going anywhere. But with growing pressure on consumer's wallets, it's not enough for a subscription service to impress customers upon sign-up; it needs to continue converting customers every cycle if subscribers are going to keep their plan.

Some brands are opting for simpler replenishment subscriptions, while others are offering more flexible features such as skipping a month or swapping products to retain customers. Brands are also discovering that subscriptions serve other important functions for their business, such as testing out new products or marketing strategies. By paying close attention to these trends, you can ensure that your subscription continues to offer value to your business and your customers.