Streamline production, cut costs, and scale smarter

Logistics

Warehousing & Fulfillment

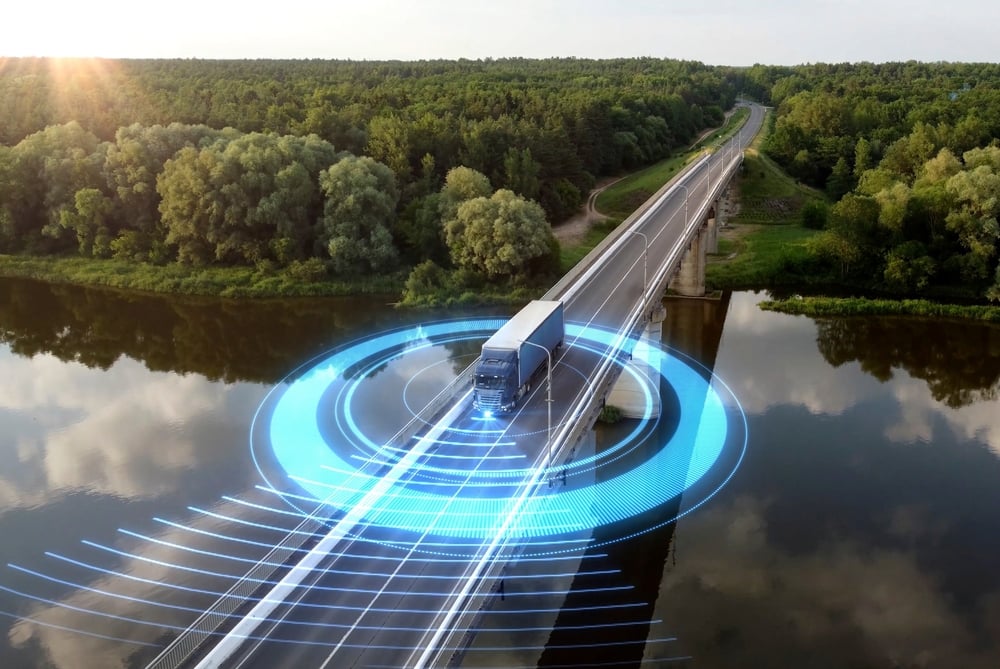

Transportation

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks